Loan Service Providers: Your Trusted Financial Allies

Wiki Article

Discover Reliable Financing Providers for All Your Financial Demands

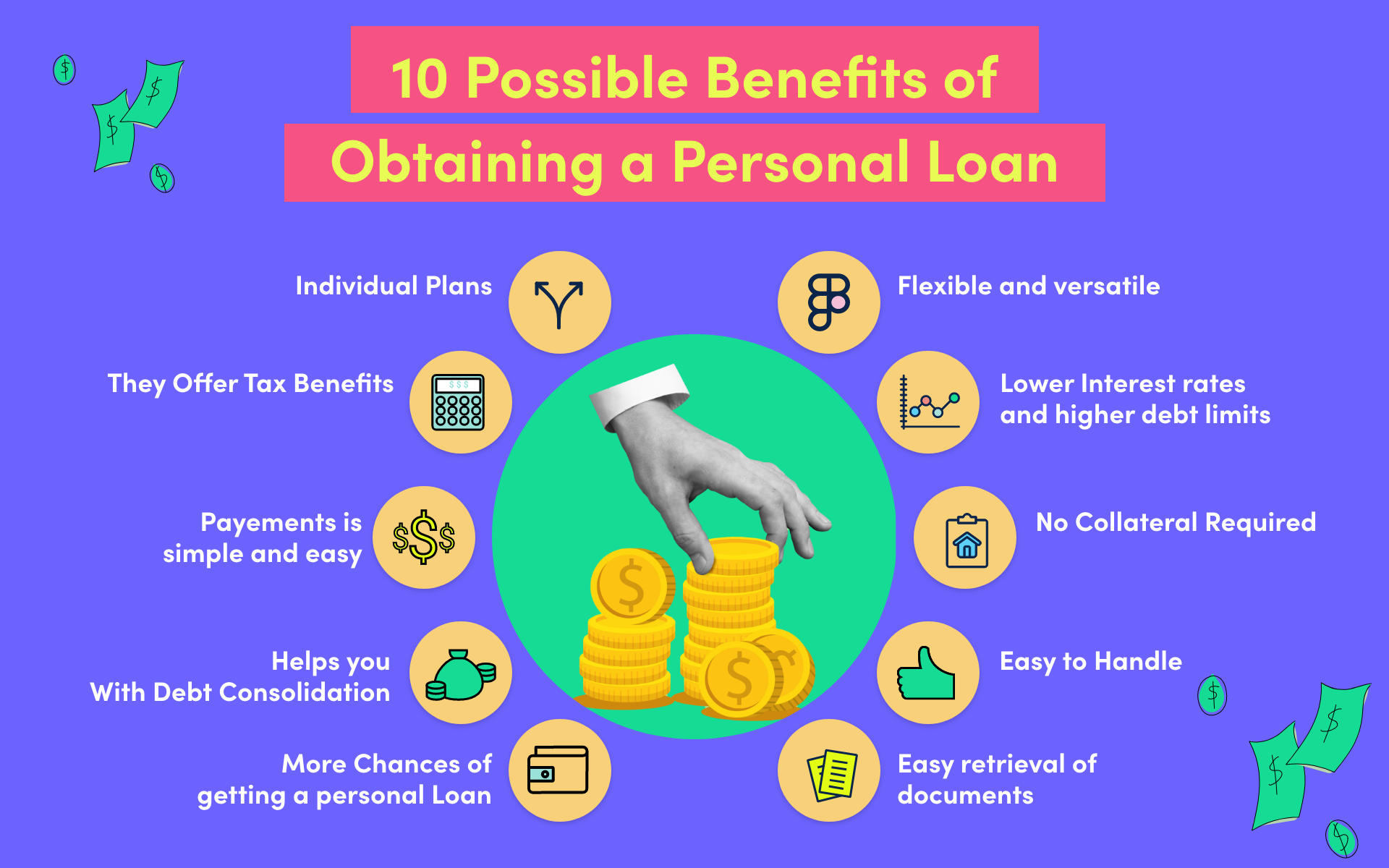

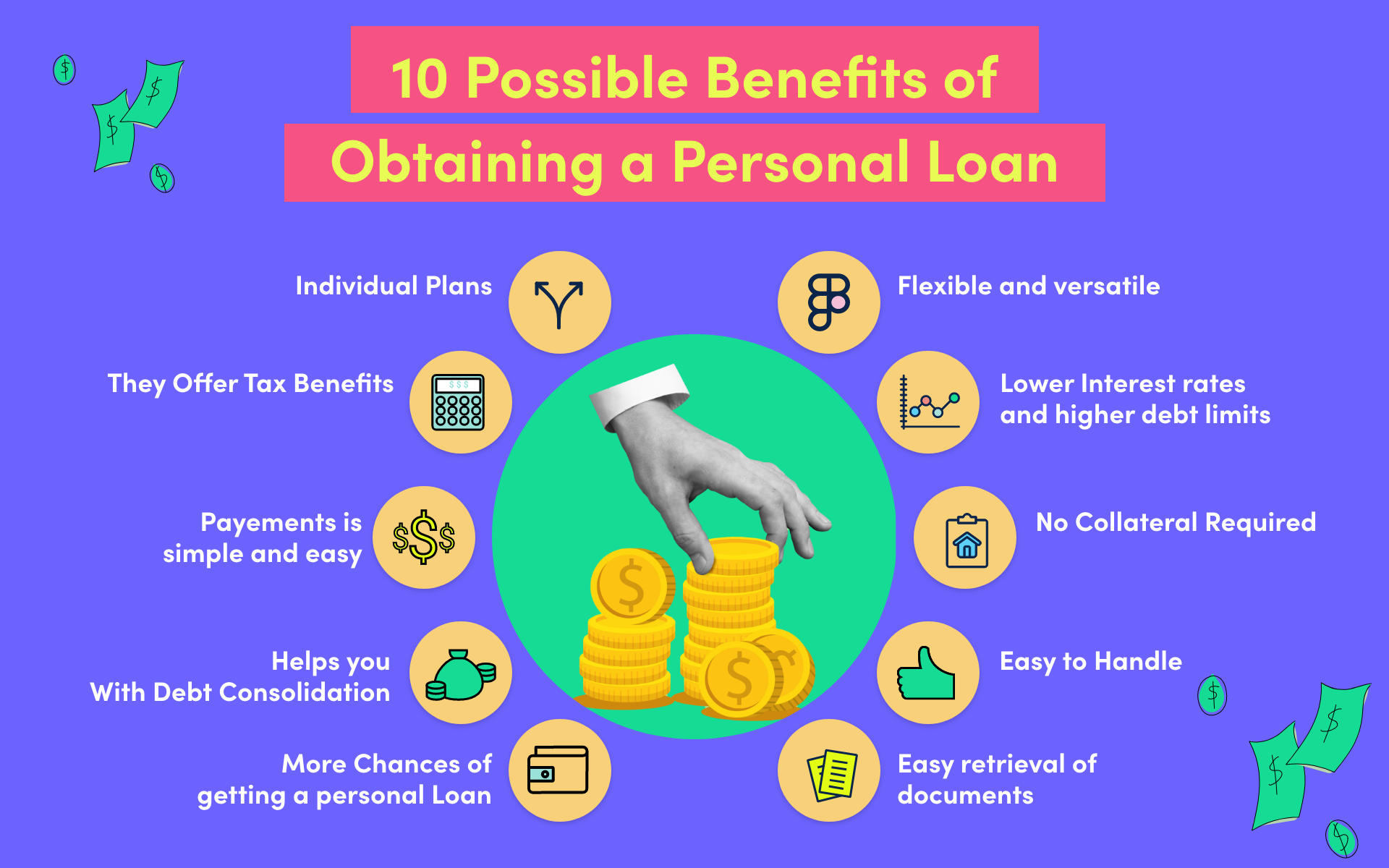

In navigating the large landscape of monetary services, finding reliable finance companies that satisfy your certain requirements can be a challenging task. Whether you are considering individual lendings, online lenders, lending institution, peer-to-peer borrowing platforms, or entitlement program programs, the choices seem limitless. Nonetheless, among this sea of options, the critical question stays - exactly how do you determine the trustworthy and dependable methods from the rest? Let's check out some crucial aspects to consider when seeking car loan solutions that are not only trusted but also customized to fulfill your unique economic needs - Financial Assistant.Kinds Of Individual Loans

When thinking about individual finances, people can select from various kinds tailored to fulfill their certain financial demands. For people looking to combine high-interest financial obligations, a debt consolidation funding is a practical option. Furthermore, individuals in requirement of funds for home renovations or major purchases may choose for a home improvement financing.Advantages of Online Lenders

Comprehending Cooperative Credit Union Options

Credit score unions are not-for-profit economic cooperatives that provide a variety of products and services similar to those of financial institutions, consisting of financial savings and examining accounts, fundings, credit cards, and extra. This ownership framework frequently translates right into lower charges, competitive rate of interest prices on loans and financial savings accounts, and a solid emphasis on client service.Cooperative credit union can be appealing to people trying to find a much more personalized technique to banking, as they typically focus on participant satisfaction over revenues. In addition, credit report unions typically have a strong community presence and may use economic education and learning sources to assist members enhance their monetary proficiency. By recognizing the choices readily available at lending institution, people can make informed decisions about where to entrust their financial needs.

Exploring Peer-to-Peer Financing

One of the key destinations of peer-to-peer lending is the potential for lower rate of interest prices contrasted to typical financial institutions, making it an enticing choice for consumers. In addition, the application procedure for getting a peer-to-peer loan is normally structured and can result in faster accessibility to funds.Financiers likewise take advantage of peer-to-peer financing by possibly gaining greater returns compared to traditional financial investment options. By removing the middleman, financiers can directly fund debtors and get a portion of the interest settlements. Nonetheless, it is essential to keep in mind that like any kind of financial investment, peer-to-peer lending carries inherent risks, such as the opportunity of consumers back-pedaling their financings.

Entitlement Program Programs

In the middle of the developing landscape of economic services, an important aspect to consider is the realm of Entitlement program Programs. These programs play an important role in providing financial aid and support to people and companies during times of demand. From unemployment benefits to bank loan, entitlement program programs aim to minimize monetary problems and promote financial stability.One prominent example of a why not try this out federal government support program is the Small Service Management (SBA) finances. These car loans supply positive terms and low-interest prices to aid local business expand and browse difficulties - merchant cash advance same day funding. In addition, programs like the Supplemental Nutrition Support Program (BREEZE) and Temporary Aid for Needy Family Members (TANF) give vital assistance for individuals and households encountering economic challenge

Moreover, government assistance programs extend past financial help, incorporating housing help, medical care subsidies, and academic grants. These campaigns intend to resolve systemic inequalities, advertise social welfare, and guarantee that all citizens have access to basic requirements and opportunities for development. By leveraging entitlement program programs, individuals and organizations can weather monetary tornados and aim in the direction of a much more safe and secure monetary future.

Final Thought

Report this wiki page